Some Ideas on Property By Helander Llc You Should Know

Wiki Article

Our Property By Helander Llc Ideas

Table of ContentsThe Property By Helander Llc DiariesThe Buzz on Property By Helander LlcHow Property By Helander Llc can Save You Time, Stress, and Money.Rumored Buzz on Property By Helander LlcSome Ideas on Property By Helander Llc You Should KnowIndicators on Property By Helander Llc You Should Know

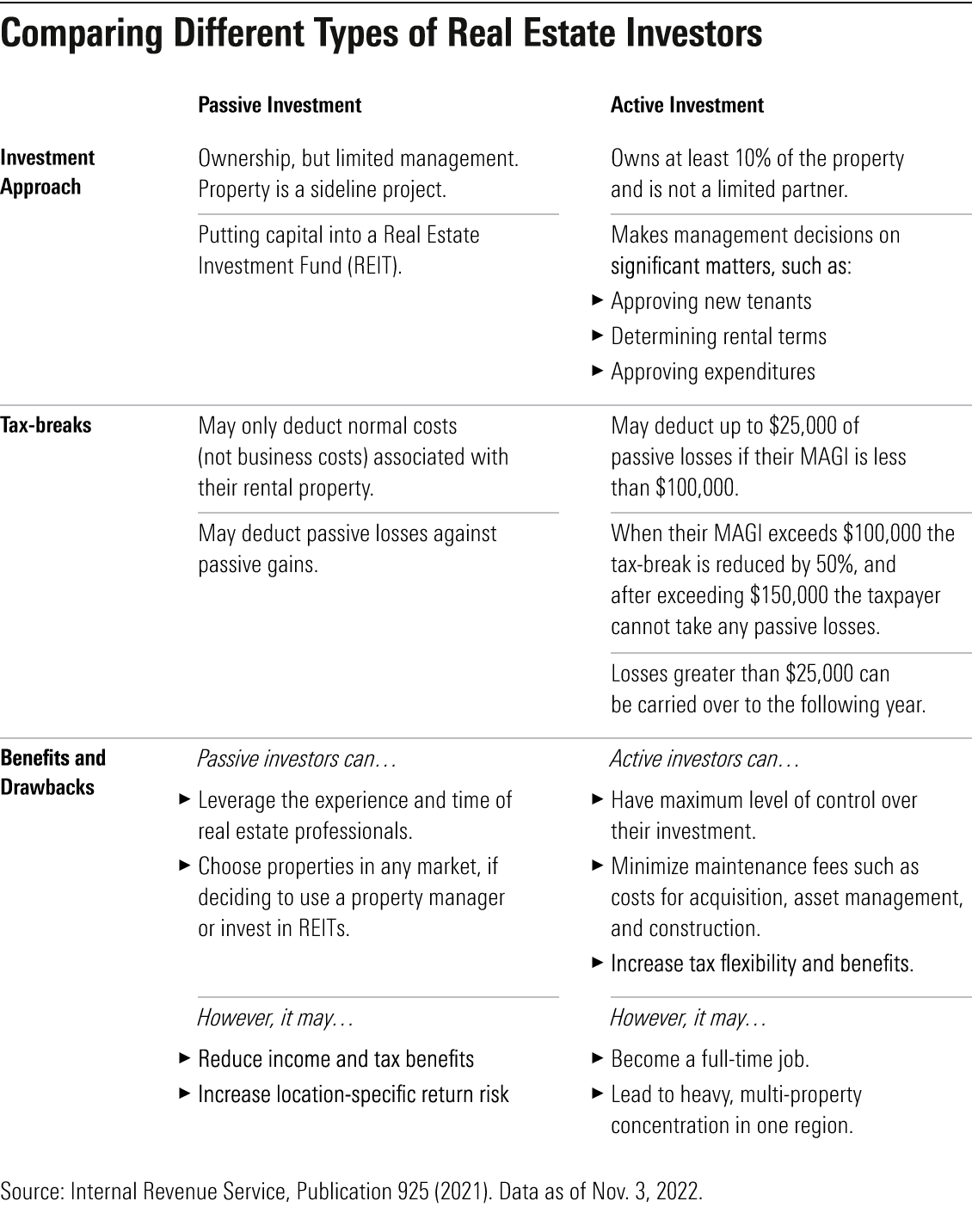

The benefits of buying realty are countless. With appropriate assets, capitalists can take pleasure in foreseeable capital, excellent returns, tax obligation advantages, and diversificationand it's possible to utilize genuine estate to build riches. Thinking of spending in realty? Right here's what you need to know regarding realty advantages and why property is taken into consideration a great financial investment.The benefits of investing in genuine estate consist of passive earnings, secure cash flow, tax advantages, diversification, and take advantage of. Real estate investment trusts (REITs) provide a way to invest in real estate without having to have, operate, or money properties.

In a lot of cases, cash money flow just strengthens with time as you pay down your mortgageand develop your equity. Investor can benefit from countless tax breaks and deductions that can save cash at tax time. Generally, you can subtract the practical expenses of owning, operating, and taking care of a home.

Getting My Property By Helander Llc To Work

Actual estate worths have a tendency to increase over time, and with a great investment, you can turn an earnings when it's time to offer. As you pay down a residential or commercial property home mortgage, you build equityan possession that's component of your internet worth. And as you construct equity, you have the leverage to get even more properties and raise money circulation and riches also much more.

Since real estate is a substantial possession and one that can work as collateral, funding is easily offered. Actual estate returns vary, relying on variables such as location, property course, and administration. Still, a number that numerous capitalists intend for is to defeat the ordinary returns of the S&P 500what many individuals refer to when they say, "the marketplace." The inflation hedging capacity of realty stems from the favorable relationship between GDP development and the demand genuine estate.

Some Of Property By Helander Llc

This, in turn, converts right into greater funding values. Genuine estate often tends to maintain the acquiring power of funding by passing some of the inflationary stress on to tenants and by incorporating some of the inflationary pressure in the form of resources admiration - sandpoint idaho realtors.Indirect actual estate investing entails no direct possession of a building or residential properties. Instead, you buy a pool over at this website in addition to others, whereby a monitoring business has and runs buildings, otherwise owns a profile of mortgages. There are numerous manner ins which having actual estate can secure against rising cost of living. Initially, residential property values might climb more than the rate of rising cost of living, leading to funding gains.

Ultimately, properties funded with a fixed-rate financing will see the relative amount of the monthly home loan settlements tip over time-- for example $1,000 a month as a set payment will end up being less difficult as rising cost of living wears down the buying power of that $1,000. Frequently, a main home is not taken into consideration to be a property investment given that it is made use of as one's home

Property By Helander Llc - An Overview

Despite the aid of a broker, it can take a couple of weeks of job just to locate the right counterparty. Still, realty is a distinctive property course that's straightforward to understand and can boost the risk-and-return profile of an investor's profile. By itself, realty offers cash circulation, tax obligation breaks, equity building, affordable risk-adjusted returns, and a hedge versus rising cost of living.

Purchasing realty can be an unbelievably rewarding and lucrative venture, yet if you resemble a lot of new investors, you might be asking yourself WHY you need to be investing in genuine estate and what benefits it brings over various other financial investment chances. In addition to all the impressive benefits that go along with spending in property, there are some drawbacks you require to consider too.

How Property By Helander Llc can Save You Time, Stress, and Money.

If you're seeking a means to purchase into the genuine estate market without having to invest hundreds of thousands of dollars, take a look at our properties. At BuyProperly, we use a fractional ownership design that permits capitalists to start with just $2500. One more significant advantage of realty investing is the capability to make a high return from purchasing, renovating, and re-selling (a.k.a.

Top Guidelines Of Property By Helander Llc

For instance, if you are charging $2,000 lease monthly and you sustained $1,500 in tax-deductible costs each month, you will only be paying tax on that particular $500 revenue monthly. That's a large difference from paying taxes on $2,000 monthly. The earnings that you make on your rental for the year is taken into consideration rental revenue and will certainly be taxed as necessaryReport this wiki page